3Q24 Market Outlook: The Fed is Navigating a Soft-to-No Landing

John P. Swift, CFA, CPA Chief Investment Officer

312-259-9595 or jswift@trustbenchmark.com

Summary

- Summary As June concludes, marking the year’s halfway point, investors naturally take a step back to reevaluate their portfolio holdings, market performance, and economic conditions.

- The equity markets, bond yields, employment and inflation all point to a softening economy, but not so much as to indicate that we will slip into a mild recession. Our soft-to-no landing economic base case continues intact.

- Magnificent 7: A Masterclass of Market Success – Potential Pitfalls & The Road Ahead

First Half Equity, Bond Yields & Inflation

U.S. indexes in June largely carried over momentum from prior months, with the NASDAQ nearing a 6% return. AI themes continued to dominate discussions among investors, with a growing worry that market breadth might be something to start worrying about for the second half of 2024. Bond yields pulled back a bit but remain up about 50 basis points across the board year-to-date. On the economic front, unemployment continues to creep northward despite positive figures from the BLS’s non-farm payrolls report, which indicates increasing worker participation rates, which is a positive sign. Inflation has plateaued, with the CPI coming in flat for May month-over-month and down slightly in June, providing more cover for the Fed to begin reducing interest rates as soon as September, but November appears more likely.

Nvidia Stock’s Breathtaking First-Half Performance

We have finally come to the end of the first half of 2024. It has been a highly eventful start, as Nvidia (NVDA) stock led the Magnificent Seven with a total return of more than 150% YTD. NVDA’s breathtaking performance briefly took its market cap ahead of Apple (AAPL) and Microsoft (MSFT) as the world’s most valuable company in late June 2024.

Except for Tesla (TSLA) and Apple stock, the rest of the Mag Seven have outperformed the S&P 500’s (SPX) (SPY) YTD total return of just over 15%.

We have consistently underscored our conviction that the strongest companies with the most sustainable competitive advantages should continue to thrive. This thesis has panned out, as the market rewarded Mag Seven investors handsomely. Moving into the second half, maintaining a core position in six of the members in the Mag Seven is vital to potential market outperformance.

Tesla (TSLA) has entered a period in their development that I call “crossing the chasm” as the early adopters have purchased their cars; more than half of these early buyers would not repeat that purchase. The early mass market will only meaningfully purchase EVs once the charging infrastructure becomes much more ubiquitous than it is today. As a result, Tesla was sold earlier this year, and Apple (AAPL) may be next after the excitement over their next generation of AI-infused devices hit the market.

The Generative AI upcycle is expected to benefit big tech companies significantly. We are still early as GenAI adoption broadens to enterprise customers.

Nvidia is seeking new growth opportunities to expand AI factories and capitalize on nascent growth drivers in sovereign AI to further its growth proposition.

In addition, cloud hyperscalers such as Amazon (AMZN), Google (GOOGL) (GOOG), and Microsoft (MSFT) are expected to strengthen their competitive moat further. It should accelerate the cloud transition while helping these companies capitalize on GenAI monetization opportunities.

Meta Platforms (META) is leading efforts to develop open-source large language models. In addition, Meta can capitalize on having access to proprietary data on Facebook and Instagram. As AI companies could run out of data to train increasingly advanced models, proprietary datasets could provide a crucial advantage in AI leadership. Let’s also remember Apple’s GenAI take with Apple Intelligence, which could spur a new wave of AI smartphone upgrades over the next few years.

The Magnificent 7: A Study in Success & The Way Forward

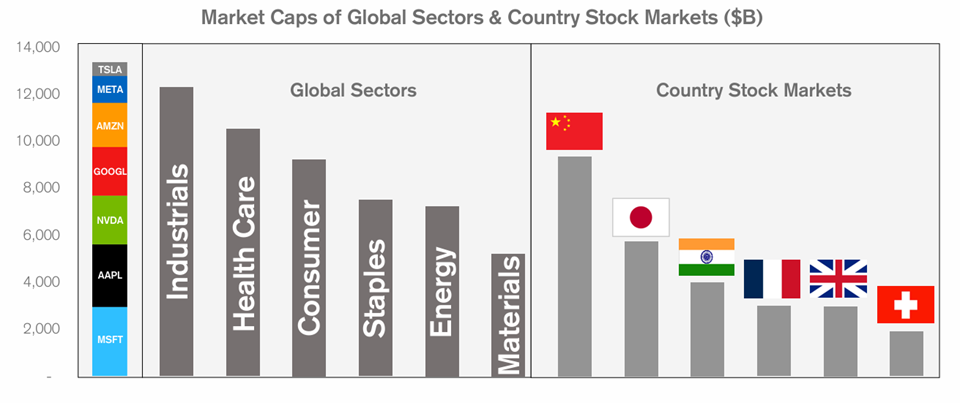

The Mag 7’s size is enormous. The collective market capitalization of these seven firms exceeds the size of the other market sectors outside of Information Technology. It is bigger than the market capitalization of the next six largest country markets outside the United States.

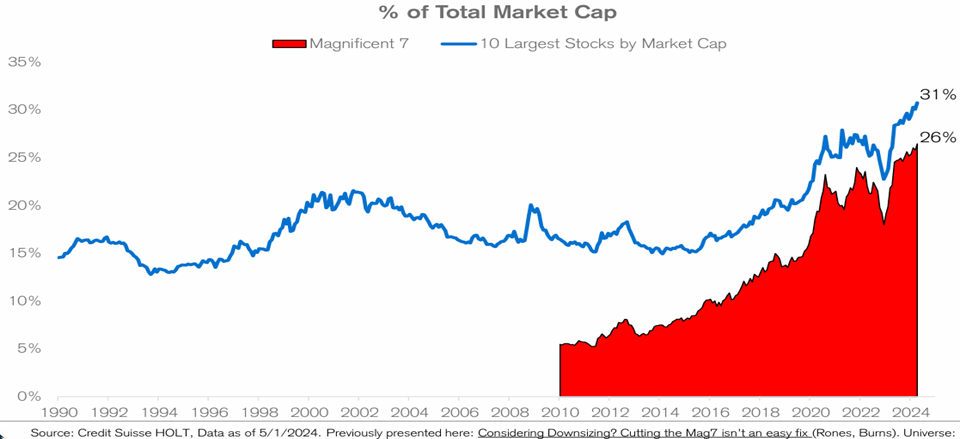

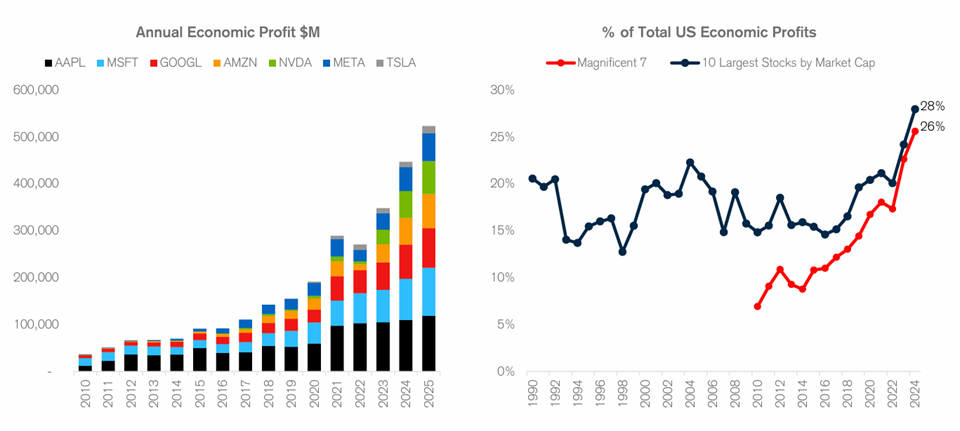

Due to the size of these seven mega cap technology stocks the concentration of the market cap is at 30-year highs.

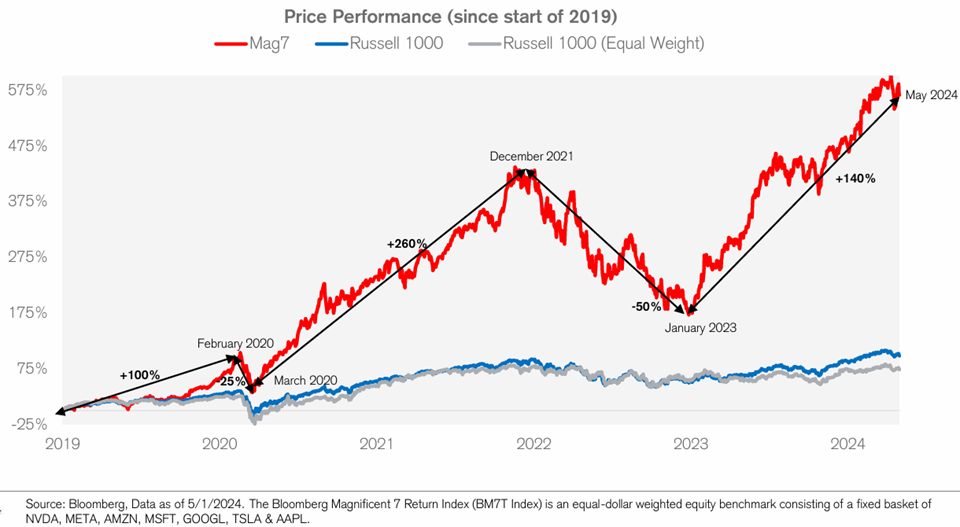

This concentration is due to the significant outperformance of the Magnificent 7 stocks relative to the market.

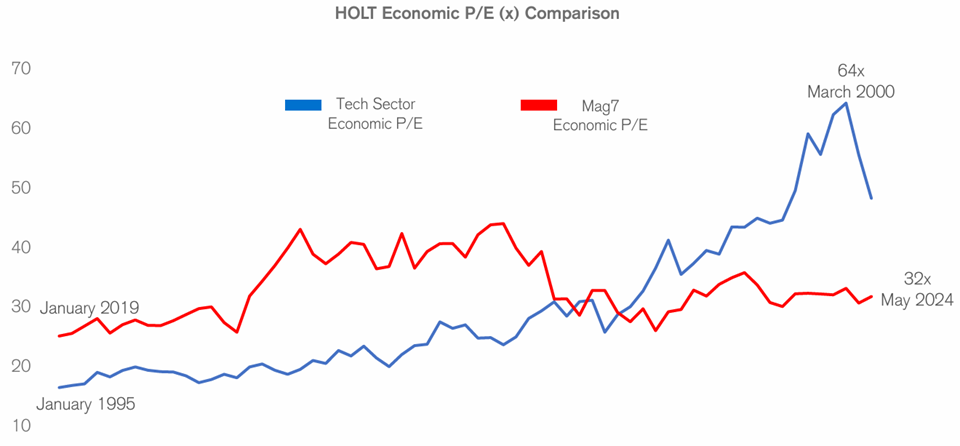

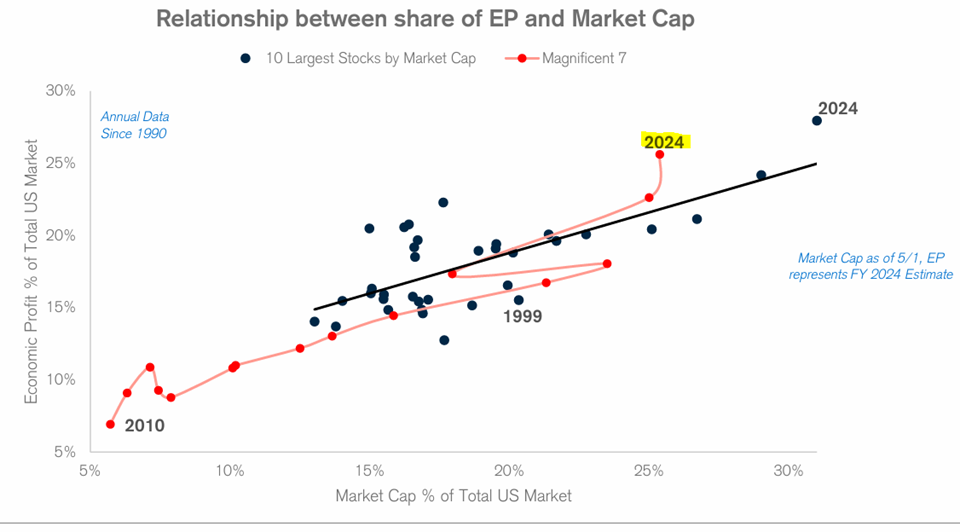

Many market prognosticators believe that these Mag7 stocks are richly overvalued, but their valuation levels are well below those seen at the top of the Tech Bubble in March 2000.

Source: Credit Suisse HOLT, data as of 5/1/24

Additionally, the Mag7 is forecasted to contribute 26% of total Economic Proft, defined as the difference between the firm’s free cash flow return on investment and its weighted average cost of capital times its market capitalization.

Finally, Mag7’s percentage of economic profits is consistent with its total percentage of Market Capitalization in the US Market, indicating that these firms are valued in total accordance with their underlying fundamentals.

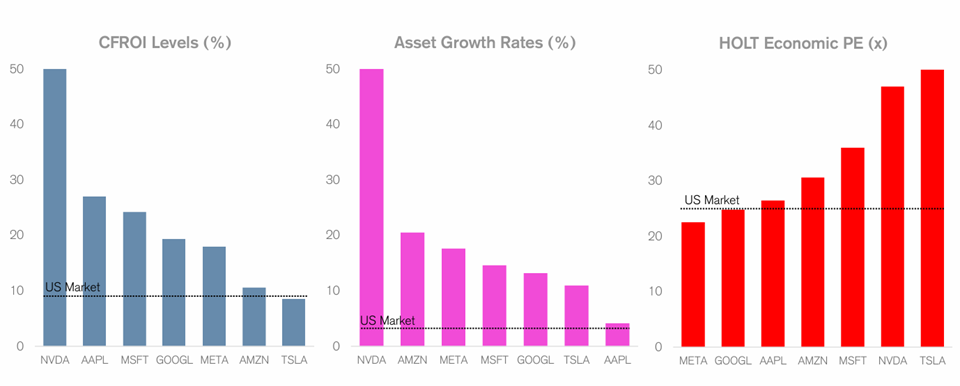

Instead of focusing on past performance, investors should focus on company fundamentals of free cash flow return on investment, and growth.

As indicated above, we sold Tesla (TSLA) earlier this year based on the deteriorating fundamentals of this business. As you can see above, they have below-market free cash flow return on investment levels while having a price/earnings ratio higher than even Nvidia (NVDA) despite the latter’s superior free cash flow return on investment. Apple (AAPL) is growing its earnings above the overall market level and is priced consistent with the average stock in the U.S. market. Still, it has superior free cash flow-generating capabilities. As such, we see some upside to holding Apple based on its potential upgrade cycle powered by new AI features. However, this firm is on the verge of becoming a consumer staple stock and a cash cow with few to no growth opportunities prospectively.

The other five stocks in this group have attractive fundamentals, and we have come to regard them as the “Magnificent 5”.

Warm regards,

John P. Swift, CFA, CPA